Apple immediately is once more taking to the press to battle again towards claims of anti-competitive practices on its App Store. Final month, the corporate detailed the outcomes of a commissioned examine that confirmed how Apple wasn’t receiving a lower of income on nearly all of App Retailer transactions — $519 billion in commerce. This time, Apple is touting the outcomes of a brand new examine that’s meant to show how Apple’s App Retailer fee fee is much like these of different app shops and digital content material marketplaces.

The brand new study additionally comes from the Evaluation Group, the identical analyst group Apple used for its most up-to-date examine. The truth that Apple has tasked the agency with rolling out a sequence of experiences to argue its case by way of market information signifies how critically Apple is taking the antitrust claims.

At the moment, Apple is going through antitrust investigations in each the U.S. the E.U. Regulators will not be solely taking a look at Apple but in addition at different high tech firms — together with Google, Amazon, and Facebook — to find out whether or not they’ve used their dimension and energy to restrict competitors. Apple CEO Tim Cook, in reality, is ready to testify earlier than the Home Judiciary Antitrust Subcommittee on Monday, July 27, making the examine’s launch much more well timed, to not point out an apparent try at shifting the narrative in Apple’s favor.

The case towards the App Store is an advanced one.

The argument for anti-competitive conduct stems from various components: that Apple requires builders to course of funds by its fund’s system, giving it a lower of transactions, versus allowing using third-party cost processors; that Apple competes with third-party builders on the identical platform whereas cashing in on its rivals’ companies; that Apple doesn’t permit builders every other technique of distribution on its iOS platform in addition to itemizing on the App Retailer, which limits all types of apps from publishing; that Apple offers its personal first-party apps deeper and extra granular entry to its working system’s controls and options; and eventually, that the price of doing enterprise on the App Retailer — sometimes, a 70/30 break up between Apple and builders — is just too excessive for the providers offered, and it’s not universally enforced.

This latter level is the one Apple desires to dive into immediately.

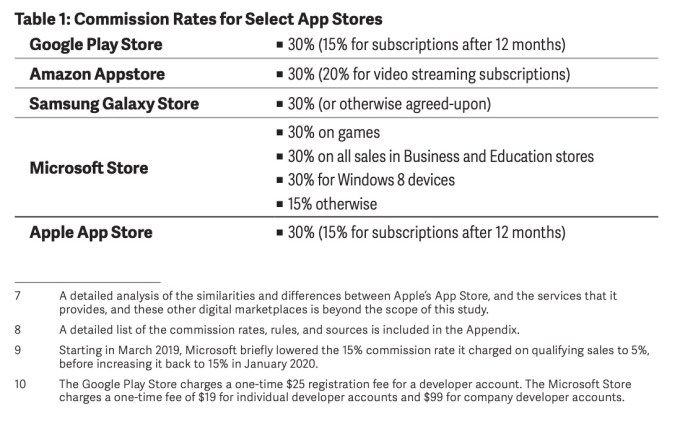

The brand new examine particulars the commission rate of Apple’s App Store and compares that with different two-sided marketplaces. On the iOS App Retailer, Apple’s fee fee is 30% for paid apps, in-app purchases of digital content material and providers, and the primary 12 months for in-app subscriptions. It falls to 15% after the primary 12 months for subscriptions.

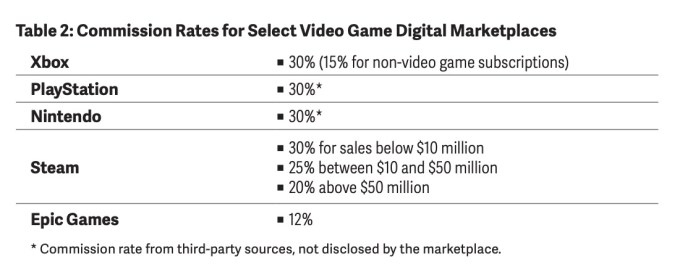

This examine factors out that almost all app stores and online game marketplaces have the identical fee construction as Apple’s (30%). This contains the Google Play Store, Amazon Appstore, Samsung Galaxy Store, Microsoft Store, plus recreation marketplaces throughout Xbox, PlayStation, Nintendo and Steam platforms (Steam is 30% for gross sales beneath $10 million). Some shops drop the 30% fee fee in particular circumstances — for instance, Steam drops it for larger gross sales; Amazon fees 20% commissions on video streaming subscriptions; Xbox charges 15% for nongame subscriptions, and so forth.

Epic Video games, the makers of Fortnite and one of many bigger firms arguing towards the present App Retailer mannequin, fees 12%, nonetheless. That firm has additionally notably acknowledged its perception {that a} decrease fee can assist to gasoline developer innovation and will increase competitors.

The brand new examine moreover particulars the fee charges for a variety of non-app retailer/recreation retailer platforms, together with digital content material platforms, e-commerce marketplaces and even brick-and-mortar retailers.

Among digital content material platforms, the examine appears at companies like Roku, YouTube, Amazon Prime Video Direct, Spotify’s Anchor, Nook, Audible, Patreon and others — lots of that are 30% or larger. It factors out that e-commerce marketplaces will generally exceed the 30% commission rate. This a part of the examine tracked commissions at 17 large digital marketplaces, together with Amazon, eBay, Etsy, Walmart, Poshmark, Airbnb, Uber, Lyft, Stubhub, Ticketmaster, TaskRabbit and others.

The examine even notes that builders can earn more money by digital distribution than by brick-and-mortar, which is an odd level of comparability, actually.

The report is useful by way of having all this commission information centralized for simple reference in a single place, as typically firms disguise their fee construction deep of their Assist documentation, if they freely publish it in any respect. But it’s additionally, broadly talking, frequent knowledge — and fully lacking the purpose. The antitrust points surrounding Apple’s App Retailer will not be about whether or not Apple is charging extra than different digital marketplaces. It’s about whether or not that commission construction is hindering competitors, given Apple’s dimension, wealth and energy.

Apple might have gotten forward of this complete downside by merely reducing its fee and increasing its current carve-out for what it calls “reader apps” — people who permit customers to entry beforehand bought content material or subscriptions. At the moment, reader apps embrace magazines, newspapers, books, audio, music, video, entry to skilled databases, VoIP, cloud storage and different accepted providers like classroom administration apps. That is, for instance, how streaming providers like Netflix are allowed to distribute an app that doesn’t provide sign-up, solely a login.

However as an alternative, Apple is doubling down. That the corporate is battling over its 30% commission, arguing brazenly that the fee is each commonplace and honest, is a sign of the rising significance of Apple’s Companies companies to its bottom line.

That enterprise is led by its Digital Content material and Companies section, which incorporates the App Retailer. In Q2 2020, Apple’s Services income hit an all-time excessive of $13.35 billion, up from $11.45 billion in the identical quarter last year. With each quarter, Companies grows extra crucial to Apple’s general development as an organization, significantly because the smartphone market itself turns into extra saturated and newer economic pressures, just like the pandemic, dampen iPhone gross sales.